Hi all, and welcome back on The Macro Compass!

A quick reminder that from January 1st, getting access to this content (and much more!) will require a paid subscription.

The exclusive offer to get in by paying 8 months instead of 12 runs for only 7 more days, and 86% of the available spots have already been taken.

Not much time left: check out which subscription tier suits you the most and take advantage of this exclusive offer!

Ok, Recession: But When, and How Hard?

Audio note not available due to Substack technical issues.

As my mentor used to say, any market practicioner can make headlines by screaming something wildly out-of-consensus but conveniently leaving the details of his forecast out of the equation.

How many times have you heard that ‘‘the US Dollar will fall apart’’ or that ‘‘the real estate bubble will burst’’ over the last 10-20 years, yet without a clear time horizon for this call to play out?

If only you got 1 USD (pun intended) for every time you heard something like this, you’ll be rich by now.

Now, it seems most analysts ‘‘expect a recession’’.

Ok, but when will it hit and how hard will it be?

The answers to these two questions are very important for asset allocation in 2023.

In this article we will:

Refresh 5 forward-leading indicators within our macro framework, and assess their diagnosis for when and how hard the next recession will hit;

Present our conclusions and discuss the principles for asset allocation going into 2023.

The Diagnosis

First of all: shall we agree on what characterizes a recession in the first place?

While many refer to 2 consecutive quarters of negative GDP growth as the main signal for a recession, the US National Bureau of Economic Research (NBER) instead looks at a wide array of real economic activity and precisely: real personal income and expenditures, employment, inflation-adjusted retail sales, and industrial production/corporate profits.

In other words: it focuses on consumers, the labor market and corporate activity.

I agree with this broader assessment of a recession.

The labor market, real consumer spending and earnings have materially slowed down in the last few months but we aren’t in a recession yet - no widespread job losses, no materially negative EPS growth yet.

Yet, the direction of travel is definitely negative - so, when recession and how hard?

Let’s try to answer these two questions by refreshing 5 of the most relevant leading indicators within my macro framework.

#1: The Global Credit Impulse

Every real recession brings negative earnings growth with it.

My preliminary results for the October update to my flagship Global Credit Impulse index point to a further deterioration of the pace of real-economy money creation.

The global credit impulse (blue) leads S&P500 earnings growth (orange) by roughly 9-10 months, and given its rapid decline in 2022 it’s now pointing to negative YoY EPS by March 2023 already.

How bad?

Historically, rapid declines in the Global Credit Impulse to negative levels have preceded YoY earnings contraction in the 10-15%+ area.

Pretty bad.

#2: The Conference Board Leading Indicator Index

The US Conference Board puts together a leading index which incorporates the top 10 statistically significant forward-leading indicators for the US economy.

Its track record in anticipating recessions is very solid: over the last 50+ years, every time the YoY series of this index prints in negative territory for 2+ consecutive months a recession is guaranteed.

That trigger was hit in August 2022, and the median lead time is 7 months.

Recession starting in March 2023?

As this indicator keeps dropping, it’s hard to estimate the magnitude of the recession yet - it first needs to bottom, and then we will be able to quantify that.

For the time being: recession to start in March 2023, according to this forward-looking indicator.

#3: The Housing Market

In 2007 Edward Leamer of the University of California stated that the housing market IS the business cycle.

I believe he is fundamentally right.

Housing-related jobs and economic activity represent anything between 12-15% of US GDP and employment alone, and the interest-rate sensitive nature of the real estate business makes it very prone to rapidly respond to changing economic and financial conditions.

The NAHB housing index (orange, inverted) leads trends in US unemployment rate (blue) by roughly 12 months.

According to the Sahm Rule, a recession starts when the 3-month moving average of the US unemployment rate (U3) rises by 50+ bps relative to its low during the previous 12 months.

In this case: 4.2% unemployment rate would suffice.

Looking at the sharp deterioration in housing activity and the usual 12-month lagged effect it has on the labor market, we should get there by Q2-23.

How bad?

Unemployment rate is set to rise to the 6-7% area by late 2023, which would be roughly double where it stands today.

Pretty bad, according to the NAHB housing market indicator.

#4: Philly Fed New Orders

The Philadelphia Fed survey is a very interesting soft indicator: it goes out to only 125 individuals, but these are Chief Executives of relevant companies and hence tend to have a good grasp of where economic activity is headed.

One of the most important parts of that survey is the ‘‘Forecast for New Orders’’ subsection: C-Suites get asked about what they see ahead for business activity.

Over the last 40+ years, every time the 12-month moving average of the Philly Fed New Orders dropped below 15 for 2+ consecutive months, a recession always followed.

That trigger was hit in September 2022, and the average lead time for a recession is 8 months: Q2-23?

How bad?

Again, early to say - but judging by how fast this index has declined already, it won’t be a very mild one.

#5: The Guts of Mr. Market

Stanley Druckenmiller once said the best economist he knows is the guts of the stock market.

I love that quote, and I think it can be extended to the guts of Mr.Market in general.

For instance, the Copper to Gold Ratio does a good job at telling us whether the real economy is set to deliver an acceleration or deceleration in growth.

The chart below shows the Copper/Gold ratio (orange) against the YoY EPS growth in the S&P500 companies (blue): the recent underperformance in Copper suggests earnings should soon flatline and head into negative growth territory by March 2023.

How bad? Hard to say - but continued industrial commodities underperformance against precious metals would be a red flag.

Finally, any meaningful yield curve slope has been deeply inverted since April 2022 already - another harbinger for a recession in 2023.

But what happens to asset classes and portfolios during a recession?

Conclusions & Asset Allocation

Updating my macro framework and refreshing some of my leading indicators, the base case seems to be a relatively severe recession hitting around March/April 2023.

While we have recorded two quarters of negative GDP growth this year, the upcoming economic contraction is likely to involve job losses and negative earnings growth - hence fulfilling the broader criteria for a recession.

Is it priced in?

No.

The direction of travel is correct: analysts expect earnings and GDP growth to slow, and markets have priced in mildly wider credit spreads and the Fed to gently cut rates by ~50 bps in the second half of the year.

The magnitude isn’t.

If you want to get a better idea of how markets and policymakers react to a disinflationary recession, one of the best parallels would be 2001.

In 2000, the Fed hiked to 6.5% and took off the excess animal spirits in markets.

In 2022, the Fed hiked to ~5% and took off the excess animal spirits in markets.

In 2001, job market losses and earnings contraction followed.

In 2023…

…the economy is going to be a reflection of the massive monetary and fiscal tightening in 2022.

In H2-23, I expect the Fed to really start pivoting exactly like it happened in 2001.

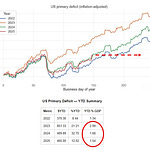

Here are the asset classes returns for 2001:

Bonds were the clear winners, and USD cash also did well.

Despite the massive Fed pivot, the S&P500 dropped another 12%.

I am preparing my Long-Term ETF portfolios and Tactical Trades bearing this historical parallel in mind.

And this was it for today, thanks for reading!

If you enjoyed the piece, please click on the like button and share it with friends :)

Finally, a quick but important reminder.

From January 2023, The Macro Compass will graduate from a newsletter to a comprehensive macro platform.

Our quality content will become much more frequent and be enhanced by macro courses, interactive tools, model ETF portfolios/tactical trade ideas and much more.

Starting January 2023, getting access to this premium content will require a paid subscription.

As a newsletter reader, if you are amongst the first 2,000 subscribers (only ~290 spots left) you can get access to the TMC services for the entire 2023 paying only 8 months instead of 12!

The offer is valid until Nov 30 (7 days left) and applicable to all the tiers below.

The Long-Term Investor

Full price in January: €399/year (39/month)

Using the ‘‘TMC’’ discount code now: €319/year (26/month = pay 8 months, get 12)

Subscription link here

Weekly macro & market insights;

Long-only model ETF portfolios;

25% permanent discount on all macro courses.

The All-Round Investor

Full price in January: €1249/year (125/month)

Using the ‘‘TMC’’ discount code now: €999/year (83/month = pay 8 months, get 12)

Subscription link here

The Long-Term Investor services;

Timely macro & market reports around big events or volatile market conditions;

Tactical trade ideas;

Interactive macro tools (!);

50% permanent discount on all macro courses

A monthly group Q&A Zoom call.

The Pro Investor

Full price in January: €5000/year (500/month)

Using the ‘‘TMC’’ discount code now: €4000/year (333/month = pay 8 months, get 12)

Subscription link here

The All-Round Investor services;

An exclusive monthly deep-dive cross-asset piec

e;

Bespoke trade ideas for institutional investors;

Pro-level interactive macro tools (!);

Possibility to access me via Zoom, calls or email.

Subscribing to any of the tiers above now will guarantee you lock-in early bird prices and your subscription will cover the entire 2023 calendar year.

For more information, here is the website.

I hope to see you onboard!

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.