‘‘We want to perceive ourselves as winners, but successful investors are always focusing on their losses.’’

Peter Borish - Founding Partner of Tudor Investment Corporation

Hi all, and welcome back to The Macro Compass!

This week felt like the good old days.

I was in London for some conferences, but most importantly for the Indian food…kidding: I meant to meet clients and friends working for the top macro hedge funds in the world.

These are amongst the most sophisticated macro investors out there - they deploy a great deal of analysis and tools to come up and correctly size macro trade ideas, and yet this is not their top skill.

They excel because they are humble about markets - always wondering whether there is really good risk/reward in that trade and where their macro thesis could go wrong.

The Macro Compass has always been about sharing my never-ending macro learning journey with you guys.

Today, I want to have a peek over the shoulders of the top macro hedge fund managers.

Together with you!

In this article, we will:

Unpack the main thinking and market musings of three influential macro hedge fund managers;

Summarize the main implications for portfolio allocations & tactical trade ideas.

Welcome to the Dark Side of Derivatives

Actually, before we jump right in.

If you are reading The Macro Compass, you’ll probably be interested in other good quality newsletters.

The guys at The Daily Upside are doing a great job at sifting through the clickbait-y headlines traditional financial media poses.

Instead, their team of investment bankers, scholars, and journalists condense the latest financial stories in a clear, concise, and occasionally witty daily newsletter - it is read by over 750,000 people every day and by the way…it’s free!

I definitely recommend checking them out: here is the link.

Back to it: I will not reveal the identity or the hedge fund these PMs are CIOs or work for, but I will give you some background color to best contextualize their takes.|

Ready? Let’s go.

#1: Macro Rates & Credits Hedge Fund CIO

This crispy European gentleman is somebody with a long history in global fixed income strategy and fund management who now runs a rates & credits focused macro hedge fund.

‘‘Alf, where is the trade?’’

I love this - you can chat macro narratives all you want, but where is that good risk/reward trade we all look for?

He sees the world healing from inflationary pressures: the global supply chain is easing, core goods inventories abound while new orders remain weak, a big deleveraging in China is likely to keep that demand engine at bay etc.

All very disinflationary, he argues.

But I showed him this chart and asked: isn’t this priced in already?

The chart below shows how markets expect a 5%+ drop (!) in US CPI over the next few quarters already - to find a similar market-implied CPI drop over a 12 months period you have to go back to 2008.

He agrees: his point is indeed that investing isn’t like painting on a white canvas.

We must always compare our subjective assessment of scenarios ahead against what markets are discounting - and right now, if your investment thesis solely relies on a sharp slowdown in inflation…well, it’s kinda priced in.

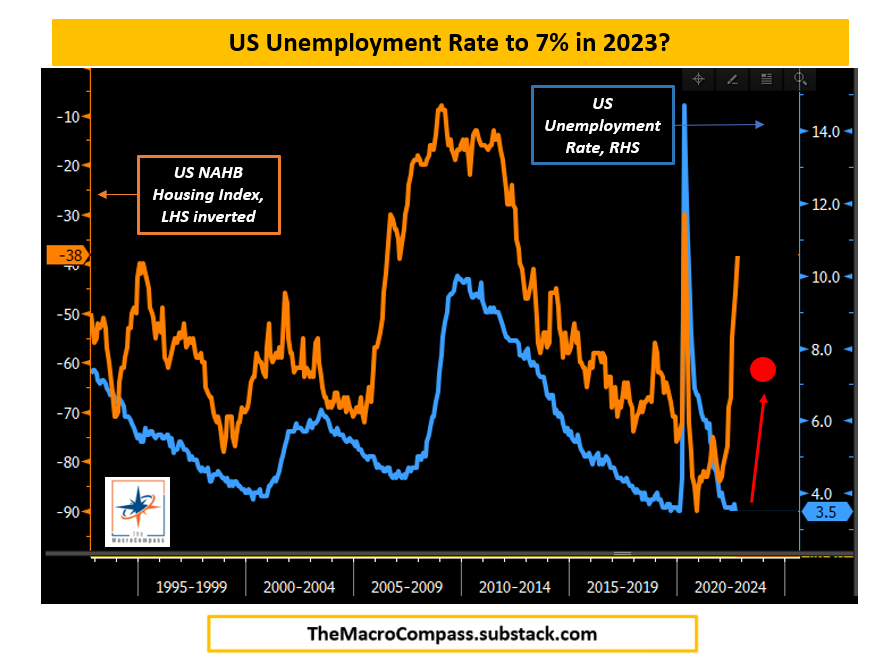

But here is where he disagrees with markets: the labor market will take a bigger hit than priced in, and earlier than expected.

The ‘‘bull case’’ for the housing market ahead is a total freeze: new marginal buyers are priced out due to the combination of today’s prices and mortgage rates, and sellers will hold on for as long as they can to avoid hitting a lower bid on their planned sales.

But this means (plenty of) pain for housing-related job creation.

The math is simple: given its demographics and labor force growth, the US needs to add roughly 90k jobs per month to keep unemployment rate stable.

Housing related activity (brokers, construction, furniture shops etc) accounts for almost 20% of US GDP and ~12 million jobs.

If all the other sectors merely slow towards trend job creation and only 10% of real estate related jobs are lost, US Non-Farm Payrolls could soon carry a negative (!) sign.

We agree here - the housing market IS the business cycle.

The sharp decline in the NAHB Housing Index (orange line, inverted) suggests US unemployment rate should quickly head towards 7% in 2023: such a vicious and powerful deterioration in the US job market is not market consensus yet.

So, what’s the trade?

He likes downside in homebuilders, REITS and credits linked to the real estate market.

Time to thank him, drink an espresso (oh gosh, the UK version…) and on to the next macro hedge fund!

#2: The Family Office Macro PM

This extremely smart lady works for a prominent macro hedge fund that has turned into a family office, allowing her more flexibility to take medium term risks.

All she wants to talk about is the US Dollar and monetary plumbing.

‘‘Alf: death by a thousand cuts or a sharp systemic risk event?’’

She sees the world through the lens of our USD-centric credit and economic system.

Despite the US and USD accounting for only ~10% of world trades and ~20% of global GDP, the US Dollar takes the lion share of global trade invoicing, payments and most importantly non-US based credit creation (loans and international debt issuance).

At the end of 2021, the BIS reported an outstanding amount of roughly 12 trillion of USD denominated credit (bonds and loans) sitting on the balance sheet of entities outside the US - a 6-fold increase in only 20 years.

As long as US Dollars are organically flowing towards these USD-leveraged foreign entities, the system thrives.

But for the last 6-9 months, global trade growth has slowed down and access to cheap USD funding has come to a halt.

She also thinks the US economy is in a much better shape than many people believe, and that for several reasons consumers will be able to withstand much higher rates.

This in turn will force the Fed to keep pushing.

In such a $-centric system, that means something will break.

Where and what - that matters the most for her macro thesis.

Unless the US repo or Treasury market seriously breaks, the path of least resistance seems to be the ‘‘death by a thousand cuts’’: idiosyncratic events happening at the fringes first (e.g. Turkey) and slowly moving towards the core (e.g. UK pension funds).

But that’s definitely not enough for the Fed to pivot with core inflation north of 6%.

A breakdown of the repo or Treasury market would warrant an immediate turnaround, but she argues there is nothing really broken in the UST market yet - and I strongly agree.

Wider bid-ask spreads are merely a function of much higher volatility which forces regulation-crippled market makers to be more conservative when onboarding risks, and the repo market is still functioning okay.

So if we’re looking into a ‘‘death by a thousand cuts’’ scenario, where is the next cut?

She thinks China will be forced to aggressively devalue.

Now, one last chat before heading for pizza - 50 Kalo’ in London is like eating it in Naples. Seriously.

#3: The Cross-Asset Relative Value PM

This must be one of the smartest macro investors I know - always thinking in probability terms and truly ‘‘macro-fluent’’ in all major asset classes.

He works for a large cross-asset global macro hedge fund.

‘‘Alf, everybody is still using the last 10-year framework - and they are wrong’’.

Wow, this was quite the opening line from him.

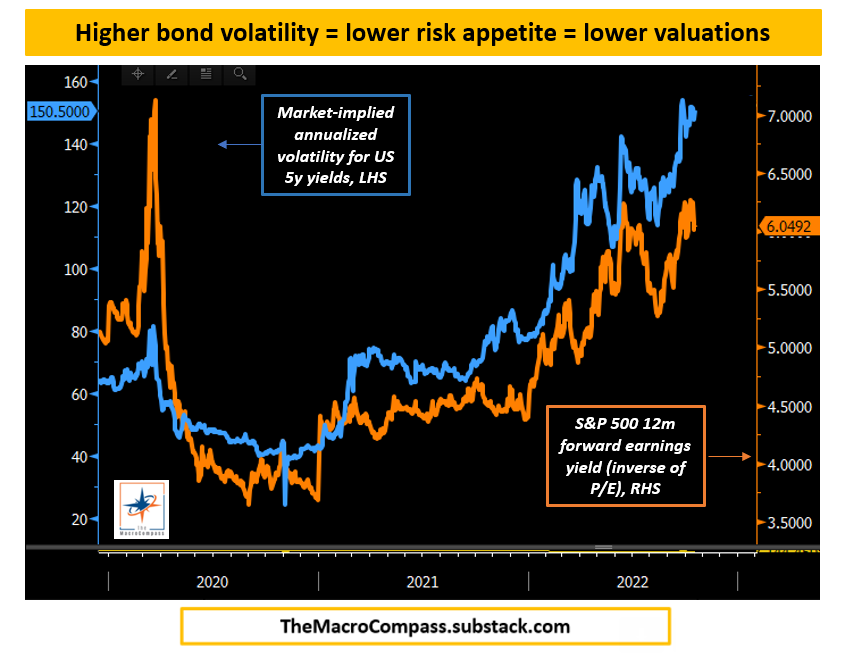

He tells me many investors are underestimasting the power of fixed income volatility and also mispricing the tails, and this matters.

Bond volatility is very important for market makers and asset allocators: if the deepest, most liquid market in the world is moving by +/-10 bps per day, it’s going to be very hard to convincigly allocate into risk assets.

But what happens if none of the tails realize, and we instead stabilize around 4.50% Fed Funds for several quarters in a row?

Bond volatility would likely move down, and here is what it does to risk asset valuations - bullish (!), on the margin.

Now to the tails.

If I ask you what’s your subjective probability that the Fed will be at 2.50% or 6.50% by December next year - basically a 200 bps cutting or hiking cycle in 2023 - what’s your answer?

The market assigns the same ‘‘fatness’’ to both the left and the right tail: ~11% chance.

He believes that in a world where we are very reasonably much tighter than neutral and by then for a long period of time, the left tail (Fed Funds at 2.5% or below) should command a higher premium than the right tail.

Instead, it doesn’t.

And that this sort of linear thinking by investors applying the last decade framework might present some chances in this highly convex macro environment.

So, where is the trade?

Let’s look a bit further into this one.

Conclusions & Portfolio Update

Being short everything and long USD cash was a great risk/reward trade given the set of macro circumstances and market pricing at the beginning of 2022 - I am happy The Macro Compass framework pointed in the right direction back then (see here).

Today, the story is a bit different.

While I remain overall very defensive, I am aware that both the medium term risk/reward has changed and bear markets often come with big vicious rallies.

The cyclical nominal growth slowdown is underway and well understood by market participants, and so is the very clear and globally concerted Central Banks’ tightening stance; on top of this, cross-asset valuations and implied vol have adjusted accordingly.

But risk premia are still mispriced, in my opinion.

Long bonds, short equities. A relative value trade.

How do you lose money on this?

1. (Real) yields stay here or keep moving up, but stocks don’t care anymore = growth and earnings must be accelerating;

2. (Real) yields drop, and equities rally more than proportionally so = Central Banks must have thrown in the towel and Goldilocks is back.

My base case is instead that either:

a) Real yields keep rising and soon (ex-US) idiosyncratic risks will turn into systemic risks, hence requiring higher risk premia or;

b) The nominal growth slowdown is severe enough to crack the labor market too, which will force the Fed to soften the stance (lower real yields) but won’t allow equities to rally accordingly - there is nothing bullish about an earnings recession.

How do you implement it?

For a long-term asset allocator, an expression of this theme would be to consider overweighting bond exposure relative to equity exposure.

If you are thinking about setting up a total return generating trade, you can do this via long IEF (IBTM for non-US investors) and short SPY (or long SH or DXS3 for non-US investors) at the same time.

Alternatively, a long 5y US bond future versus short S&P 500 futures would work too.

The trade should be beta-weighted given the different levels of volatility: my preliminary and rough calculations point to ~3 units of IEF for 1 unit of short SPY.

It’s hard out there, but The Macro Compass is here to help us navigate through these markets and this never-ending macro learning journey.

And this was all for today, thanks for reading!

I hope you enjoyed this virtual tour with the top macro hedge funds out there :)

Finally: may I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

If you are interested in any kind of partnership, sponsorship, conferences or media appearances feel free to reach out at TheMacroCompass@gmail.com.

See you soon here for another article of The Macro Compass, a community of more than 105,000+ worldwide investors and macro enthusiasts!

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Every week, I also interview the best macro strategists and risk takers around the world and ask them what’s their top trade idea on my podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks YouTube channel.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Share this post