‘‘Within our mandate, the ECB is ready to do whatever it takes to preserve the EUR. And believe me, it will be enough.”

Mario Draghi, July 2012

''We will keep at it until inflation is down to 2%. And our monetary policy tightening will be enough. It will be enough to restore price stability.''

Jerome Powell, September 2022

Hi all, and welcome back to The Macro Compass!

Yesterday’s Fed meeting was exceptionally important.

But not only because the Fed hiked by 75 bps - once again, the devil is in the details.

For instance: did you notice the uncanny similarity between Powell’s parting words at the FOMC press conference and Draghi’s famous ‘‘whatever it takes’’ speech in 2012?

And did you realize that the yield curve inversion is becoming so relentless and powerful that on a day when the Fed hikes by 75 bps, TLT 0.00%↑ actually rallies?!

After Jackson Hole, Powell and his colleagues wanted to cement a clear message we have highlighted a month ago already: Fed Pivot My A*S.

But this time the nuances in the communication, Summary of Economic Projections (SEP) and the Dot Plot coupled with the impressive cross-asset market reaction really make for an interesting set of macro developments and portfolio implications.

So, let’s get to it!

In this article, we will:

Provide a deep dive into the Fed meeting, paying particular attention to the nuances in communication, SEP/Dot Plot and cross-asset market reactions;

Assess the implications and provide portfolio/trade ideas for both long-only and tactical macro portfolios.

In Case You Didn’t Get It: Don’t Fight The Fed

Actually, before we jump right in.

Nowadays I am lucky enough to be often invited as a guest in TV shows, podcast and conferences - but mostly to talk about today’s market environment.

This time though the guys at Pepperstone (led by my friend and host Chris Weston, who was absolutely excellent) asked me to deliver something different: a 45 minutes deep dive into my macro framework, trade/portfolio construction process and risk management approach.

This unique interview is available here - for free.

Now, back to it: one of the most interesting nuances in Powell’s communication actually came very late in the press conference - basically at the very end.

With a very similar choice of words vis-à-vis Draghi in 2012, Powell said the Fed tightening ‘‘will be enough; it will be enough to restore price stability’’.

If in 2012 Draghi was trying to save the EUR, today Powell is trying to save the Fed’s credibility by winning this inflation fight.

The Fed made sure to convey this message further via the Dot Plot, the SEP and during the press conference - and markets reacted in a very interesting way.

Let’s go through it.

1. The Dot Plot - No Room For Nuances Anymore

The Dot Plot has a very poor track record in predicting exactly what the Fed will end up doing, and FOMC members themselves have been clear about it too - this is not a prediction of what they will end up doing, but rather a guidance based on today’s set of information.

Well, the change in ‘‘guidance’’ since June is very eloquent.

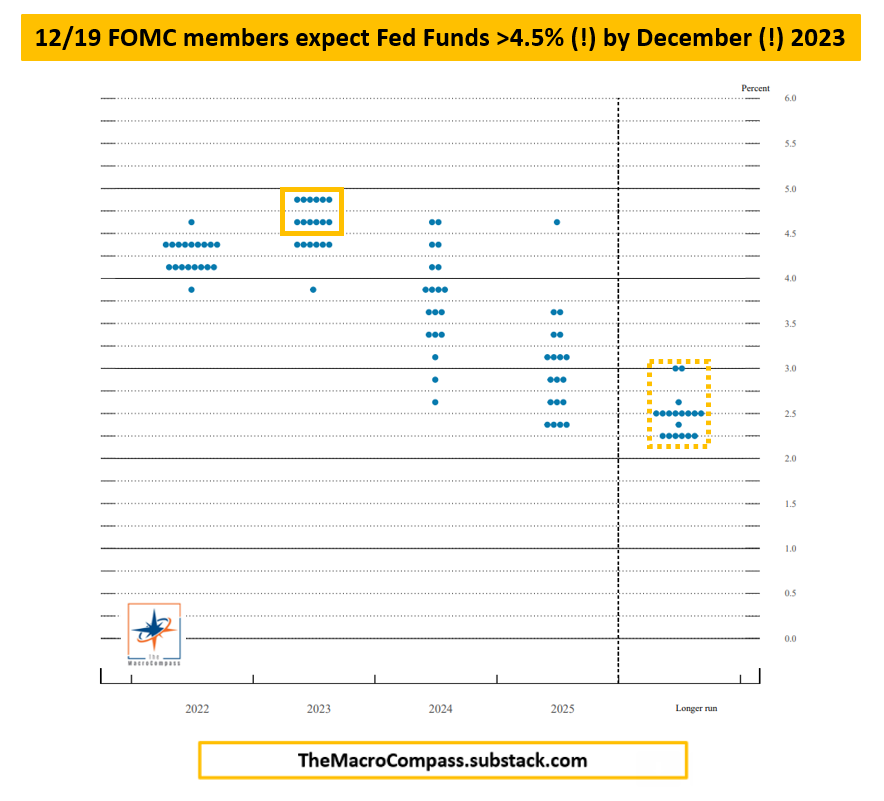

Based on today’s set of data and information, 12 out of 19 FOMC members expect Fed Funds to have to set between 4.50% and 5.00% (!) by December 2023.

Let me translate: much tighter for much longer - this is the new guidance.

Let me stress out something: when it comes to financial conditions, markets first care about the shock - which is best represented by the rate of change in US Dollar, interest rates, credit spreads etc.

And while this is widely understood, investors often underappreciate the second dimension: after the shock, markets care about the time persistence of loose/tight financial conditions.

A highly leveraged corporate which took opportunity of the historically attractive funding window in 2021 can kick the can down the road and find shelter from the ‘‘shock’’ in financial conditions, but it can hardly escape it if the shock persists over time - and this is what the new Fed Dot Plot tends to signal.

The other interesting point was that the neutral nominal Fed Fund rate is still seen in the 2.50% area: the Fed doesn’t think we are in a structural regime change for nominal growth.

So: 200+ bps above neutral (tighter) for 15-18 months (for longer).

What else did we learn?

2. Channeling The Inner Volcker?

Another subtle historical reference Powell was very keen in using was the late ‘70s inflation fight Chair Volcker had to go through.

No room for ‘‘premature relaxation’’ when restoring price stability: history teaches us that it can be a very expensive exercise - the Fed knows it’s going to cause pain to the private sector (reflected in weaker GDP and higher unemployment forecasts in their updated SEP), but it deems this solution to be preferable to the risk of unanchored inflation expectations as elevated CPI persists over time.

This chart straight from the Volcker era is very telling.

Soon after Volcker became Chair, month-on-month core inflation was almost 1.5% (!) and the Fed’s response was swift: to deal with it, Fed Funds were pushed as high as 17%. But as soon as inflation slowed down, rates were swiftly cut (first red circle).

This expensive mistake was repeated a couple of times and it ended up taking as long as 3-4 years to finally get inflation back to more acceptable (yet still high) levels.

Powell is well aware of this, and he doesn’t want to fall into the same trap.

To get there, he told us very clearly that real Fed Funds rates must be positive (well above estimates of r*, hence in the 1% area) for a convincingly long period of time.

Markets are taking him seriously: 1-year forward, 1y real Fed Funds rates have been pushed up to…1% indeed.

We know the Fed has a very strong influence on the front-end of the bond market.

The real question is: how are other asset classes reacting?

3. It’s Getting Real

Think about this: in a day when the Fed hikes 75 bps and comes up with clear references to Volcker and a super aggressive Dot Plot…$TLT rallies?!

To understand this, allow me to propose a theoretical exercise that ignores term premium and some other technicalities: please think of 30-year rates as a strip of all the future 1-month Fed Fund rates for the next 30 years.

Done?

The first 20, 30 monthly Fed Fund data points are likely to be in the 3.50-4.50% area…

…but what about the other 300+ data points?!

That’s exactly what the bond market is thinking: the more the Fed tightens, the more it inflicts long-lasting damage to future nominal growth.

And it’s not only a US story.

Risk assets took a hit across the board, but I’d like to point out as so far this is just a mechanical adjustment to the new level of risk-free real rates.

Expected defaults (credit), earnings (equities) and risk premia in general haven’t really widened much yet.

The chart below shows how even without downgrading EPS or expecting higher risk premia (left graph), the S&P 500 should already sit in the 3650-3750 area.

My proxy for equity risk premium (right chart) trades in line with its 10-year average, which is somehow contained given the current uncertain macro environment.

So, what about asset allocation and trade ideas?

Portfolio Update

Big picture first.

Forward-looking growth indicators point to further deceleration in economic activity and upcoming weakness in the labor market too.

Central Banks are as committed as ever in keeping conditions tighter for longer, and they are setting policy looking in the rearview mirror (core CPI is one of the most lagging indicators for the economic cycle) which virtually ensures they’ll be compounding recessionary forces.

My Long-Term ETF portfolio is constructed to deliver better risk-adjusted return vs a 60-40 benchmark portfolio (YTD: +2% vs benchmark -17%).

It remains positioned as follows:

Long (USD) Cash

Large Underweight in Equities and all other risk assets

Accumulating 10y+ Bonds

I didn’t yet add to the TLT and IBGL positions on this 2-4% drawdown we experienced since I started accumulating long bonds (here) - there are a lot of cross currents in global macro when it comes to fixed income, including large exporters of capital and buyers of Treasuries (Japan, Switzerland) temporarily involved in propping up their currencies and hence potentially selling USD bonds.

I still believe long bonds (and gold) will become attractive assets to hold over the next coming quarters - but some patience is warranted.

In the meantime, I remain convincingly underweight equities and long (USD) cash.

My Tactical portfolio is instead designed to generate a double-digit yearly total return (target Sharpe ratio: > 1x) via long/short trades across asset classes - an intuitive excerpt below, though the actual trade implementation might involve the use of options and futures. YTD Sharpe: 1.2x.

Few words on the short EURUSD and Russell 2000 trades:

The ECB can’t do much to stem an exogenous energy shock and (the very much overlooked) Italian elections loom large while the global deleveraging process keeps supporting the US Dollar; first target hit will be applying a trailing profit/stop loss strategy from here.

Cyclical, small-cap companies (Russell 2000) should keep feeling the heat out of earning downgrades and risk premia expansion.

You can find the rationale behind the Japanese Yen trades here.

Before I forget: I am truly grateful for your support, and I hope you appreciate the countless hours and hard work necessary to deliver The Macro Compass every week.

If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within the TMC family - they might appreciate it and after all…it’s free!

P.S. Over the next few weeks there will be a lot (!) of exciting news: stay tuned!

See you soon here for another article of The Macro Compass, a community of more than 96,000+ worldwide investors and macro enthusiasts!

If you are interested in any kind of partnership, sponsorship, conferences or media appearances feel free to reach out at TheMacroCompass@gmail.com.

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.