One of the best European government bond traders (and a good friend) on the street has his alarm set to ring at 6.15am every morning.

Every morning, the alarm rings and asks him ‘’How consensus are my trades?’’

Markets have moved sharply year-to-date, and in one clear direction: short Cathie Wood and Bitcoin, long cyclicals (banks & oil).

This relative stance has now likely become consensus.

While there are good macro reasons for the first leg of the move, the second leg seems less justified at this stage.

What are the macro drivers for this move, and how do we trade it?

Let me share my thoughts with you.

Without further ado, let’s jump right in!

A Peak Behind the Macro Curtains

On Dec 6, I argued the risk/reward for Central Banks at this juncture in the macro cycle was definitely skewed towards engineering a ‘‘gentle’’ tightening.

As the labor market heals and we enter the mature phase of the cyclical recovery, financial and monetary conditions can be gradually and gently tightened in an effort to reduce inflationary pressures.

There are two main drivers Central Banks often look at while attempting to deliver a mild tightening in financial conditions: real interest rates and credit spreads.

Why?

Because the private sector borrowing costs are nothing else than the sum of real yields and credit spreads, and those financing costs can mildly rise as far as real wages and output are growing at a decent pace too.

Mess up with this chemistry, and you have a problem.

‘‘Abrupt’’ is the key word here.

An abrupt move in real yields and credit spreads relative to real wages and earnings causes a repricing in risk premia: in that case, the chemistry has not been respected.

In order to define ‘‘abrupt’’, I looked at the 10-year history of bi-weekly moves in 5y forward, 5y US real yields.

The Jan 3-17 move ranked like this:

It was the 7th worst rolling bi-weekly move up in 5y5y US real yields (+40 bps) over the last 10 years, ranking in the worst 2% percentile of the distribution!

Wow. That’s abrupt.

Such a sharp move in real yields weighed on risk sentiment, and the highest P/E & highest beta assets were hit the most - it makes sense, as those assets are highly dependent on risk premium and their cash flows (if any) are to be seen far away in the future.

On the other hand though, the move in high-yield credit spreads (only +20 bps during the same period) didn’t rank at all as an abrupt outlier and analysts consensus for S&P500 earnings growth in 2022 moved from 9% to…8.5%.

Basically, the market told us the real economy can handle this.

See below the outperformance European Banks staged over High-Beta stocks.

As explained, there are good macro reasons for the downside move in high-beta, high-multiples but much less so for the long cyclical move to continue its upside move.

In my opinion, there are three underlying reasons why:

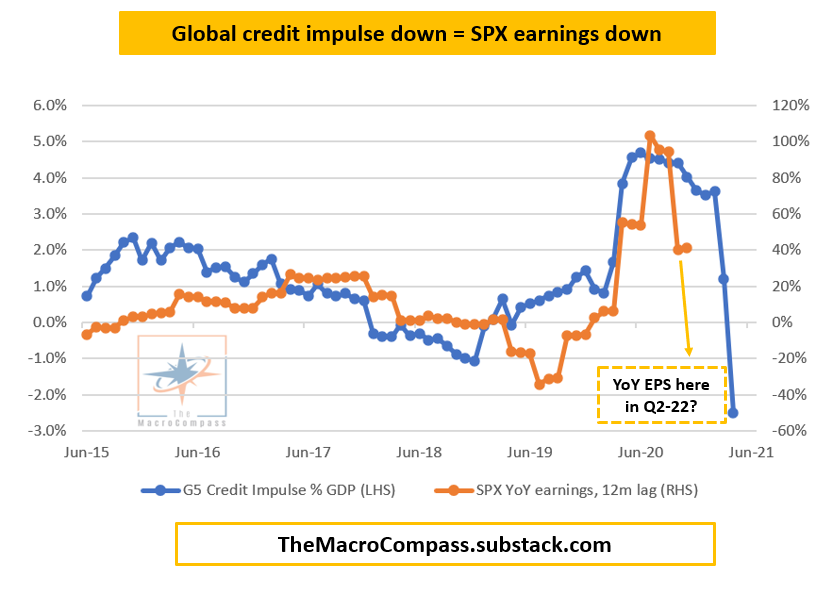

My credit impulse metric suggests earnings and inflation are going to disappoint consensus;

The tailwind from higher real yields without a substantial negative EPS repricing is likely over, as we get dangerously close to the magnetic cap represented by the 0% level for 30y US real yields;

It’s becoming pretty crowded.

Point 1: Mr. Credit Impulse is telling us the earnings bonanza is over.

Point 2: 30y US real yields traded close to 0% at some point last week. With a 300%+ world economy debt/GDP, the equilibrium levels for real yields are ever lower. We could try to temporarily break higher, but this is going to weigh on the private sector ability to hold together.

Point 3: everybody and their mother moved to chase long cyclicals and short tech.

Alright, so what are the trades here?

The Trades

Sharing my macro knowledge and framework and being fully transparent are the backbones of my work at The Macro Compass (I highly recommend Jon Turek as a fellow macro investment strategist: his Substack is worth the money, big times).

So, before we jump into the trade ideas I believe I should provide clarity on my investment approach (it’s described here in details, but there are some minor tweaks so I’ll summarize it again below).

I have two portfolios: a long-term secular portfolio where I invest 90% of my savings and a short/medium-term tactical global macro portfolio where I invest 10% of my savings. Plus, I own some real estate and some liquidity of course.

The long-term secular portfolio is invested 70% in global stocks (IWDE), 20% in US Treasuries (TLT) and 8% in Gold (PHAU) and 2% in Bitcoin.

This is primarily a secular risk-premium and earnings growth harvesting portfolio.

TLT and Gold benefit from the secular move lower in real yields while reducing my drawdowns and/or serving as a tail risk hedge for a monetary reset. Bitcoin is a highly leveraged call option on risk sentiment with some marginal potential to play a role in the Macro EndGame too.

I hardly touch this portfolio apart from yearly rebalancing.

The tactical global macro portfolio aims at generating >10% total return regardless of market conditions, and the time horizon here is 1-3 months (it can be longer though).

Every trade has a skewed stop loss/initial profit target: hard stop at -2% of remaining capital and initial profit target >3%. This way I can be right 50% of the times and still make money at year-end if I am thoroughly disciplined.

The stop-losses are generally placed at 1 standard deviation distance from entry price calculated using 4y rolling monthly returns. The trade size is adjusted such that I can lose max 2% of my capital if that 1-sigma move hits me.

I will always cut my losses and let my profits run. The former is easy to understand. The latter means that if I hit my first profit target, I move the target up and my new stop loss too (now hitting the stop actually makes money).

Profits keep on running until I hit my new stop (now a profit).

Yes, but…show me the money now!

So, here are the trades and how the portfolio looks like today:

Compared to the investment ideas published at the end of 2021 here, I have applied the following changes.

On Jan 18th: went long 10y Treasuries (publicly announced here)

Today: opened a short in Oil (rationale explained here)

Today: closed shorts on MSCI China and Gold (at a small loss) and on TIPS (at a good gain): rationale below

Today: opened a long position in Chinese Real Estate: rationale below

Closing the shorts in TIPS rather than letting the profits run is actually contrary to my baseline approach, but I felt compelled to do so as the YTD move in real yields was ferocious.

On top, I had turned bullish nominal yields and short oil hence the book was at risk of becoming way too exposed to the same macro principal component.

Similar story for gold, which was contributing to that short real rates positioning but it hadn’t delivered much despite the big move in real yields.

Finally, the newly opened position: long Chinese Real Estate (CHIR ETF), which also involved closing the short MSCI China I was running.

China has opened the credit taps again, and they have the unique possibility to direct credit when they want and where they want it.

The 2022 CCP Politburo is coming, and the private sector deleveraging has been big and lasted for long enough – the latest PBOC action and the clear guidance given to state-owned banks should be sufficient to allow for a decent rebound in Chinese Real Estate from the large drawdown we have experienced over the last 3 quarters.

A trade to own for few months (or quarters, who knows), hence the sizing is smaller than usual to allow for stops and profit targets to be placed a bit wider than usual (stop loss at 2-standard deviations instead of 1-sigma).

In a nutshell: the abrupt rise in real yields has hurt risk assets, with the highest beta sectors hit the most while cyclicals have outperformed. Looking ahead, my macro framework shows that nominal growth is likely to disappoint and further episodes of aggressive rise in real yields are not desirable from a policymaker point of view.

Hence, I start leaning long assets that are likely to benefit from slowing nominal growth without further repricing of risk premia (10y Treasuries, Nasdaq) against asset classes in need of strong earnings to perform (Russell, Brazilian equities).

I added a long Chinese Real Estate as I see first concrete signs the CCP/PBOC have opened the credit taps again and the underperformance in this sector has been acute.

Last famous words.

If you enjoy my work, please consider clicking on the like button and share the article.

It costs you literally nothing, but it would really make my day!

Are you an institutional investor who likes The Macro Compass and would be interested in a bespoke, pro-to-pro coverage?

Are you looking for any other kind of partnership or collaboration?

Feel free to get in touch at themacrocompass@gmail.com.

See you again on Monday!

Share this post